unified estate and gift tax credit 2021

Spouses splitting gifts must always file Form 709 even when no taxable gift is incurred. The estate tax is a tax on your right to transfer property at your death.

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

The 117 million exception in 2021 is set to expire in 2025.

. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. This is called the unified credit. If you die in 2020 after making such a taxable gift you will still be able to transfer assets worth 11 million through your will trust or otherwise estate tax-free.

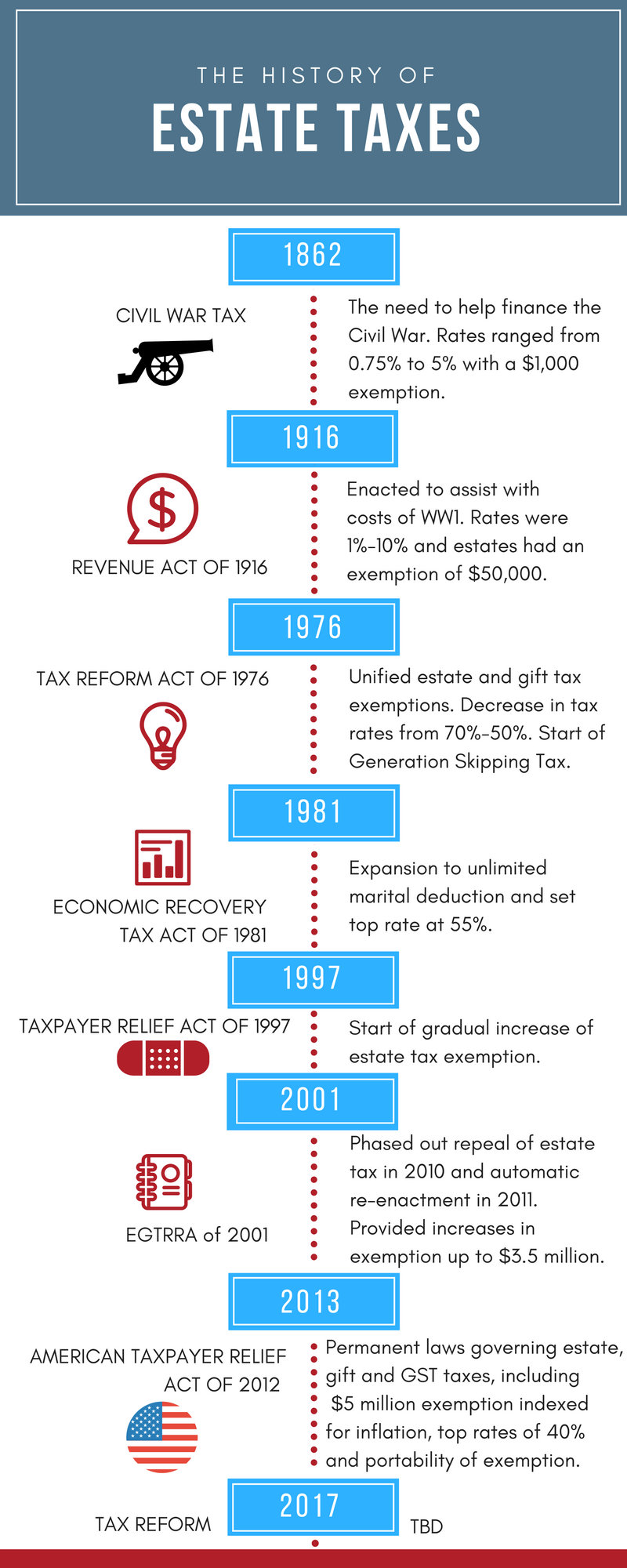

If you need more information about the unified tax credit use our. ESTATE AND GIFT TAXES Estate Taxes 2021 2020 Estate tax exemption 11700000 11580000 Unified estate tax credit 4577800 4577800. Wednesday January 20 2021.

The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021. This of course could remain subject to change. The size of the estate tax exemption meant that a mere 01 of.

However if your gift exceeds 16000 to any person during the year you have to report it on a gift tax return IRS Form 709. After 2025 the exemption will revert to the 549 million exemption adjusted for inflation. Oak Street Funding Well Get You There.

A unified tax credit can reduce or eliminate your federal tax obligation while also integrating federal gift and estate taxes into one unified tax system. 675000 or more for individuals dying on or after January 1 2001 even if the Federal Estate Tax Return IRS Form 706 for decedents dying in 2002 and thereafter is not required to be filed. If you made other taxable gifts during life then the Unified Credit available at your.

What Is the Unified Tax Credit Amount for 2021. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. In addition the annual gift tax exclusion to each person or organization is 15000 with no limit.

It increased to 1206. Learn about the COVID-19 relief provisions for Estate Gift. Under the 2018 law the inflation-adjusted lifetime transfer tax exemption is 117 million for an individual and 234 million for a married couple in 2021.

Your available Unified Credit is effectively reduced from 1158 million to 11 million. In the case of estate and gift taxes the unified tax credit provides a set amount that any individual can gift during their lifetime before any of these two taxes apply. The estate and gift tax exemption is 117 million per individual up from 1158 million in.

The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million on January 1 2026. It consists of an accounting of everything you own or have certain interests in at the date of death. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure.

The unified credit against estate and gift tax in 2022 will be 12060000 up from 117. For a decedent whose death occurs on or after January 1. For 2021 that lifetime exemption amount is 117 million.

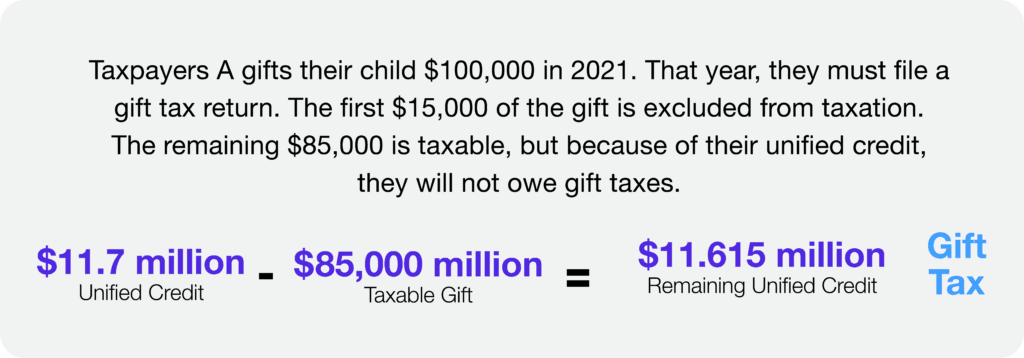

Estate and Gift Taxes. Unified Tax Credit. Once you give more than the annual gift tax exclusion you begin to eat into your lifetime gift and estate tax exemption.

What Is the Unified Tax Credit Amount for 2021. Find some of the more common questions dealing with basic estate tax issues. The estate tax exemption is adjusted for inflation every year.

Unified estate tax credit 4577800 4577800 Top estate tax rate 40 40 Gift Taxes 2021 2020 Lifetime gift tax exemption 11700000 11580000 Annual gift tax exclusion Gifts per person. A tax credit that is afforded to every man woman and child in America by the IRS. As we discussed in more detail here Congress previously proposed as part of the Build Back Better Act accelerating the sunset of the exemption to January 1 2022 and essentially.

In October 2020 the IRS released Rev. 2020-45 which sets forth inflation-adjusted items for 2021 or various provisions of the Internal Revenue Code. As of 2021 married couples can exempt 234 million.

Some items of interest from an estate planning perspective are the following. This credit allows each person to gift a. The transfer exemption is a unified tax credit that includes both estate and gift taxes.

While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the Unified Credit for Estate taxes from 117 million to. Beginning in 2022 the annual gift exclusion will be 16000 per doner up from 15000 in recent years. The federal estate tax exemption for 2022 is 1206 million.

The Internal Revenue Service announced today the official estate and gift tax limits for 2021. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. For 2021 the annual exclusion for gifts is 15000.

A DC Estate Tax Return Form D-76 or Form D-76 EZ must be filed where the gross estate is. The gift tax and the estate tax share the same exemption often referred to as the unified tax credit. Annual Gift Exclusion for 2021.

The gift and estate tax exemptions were doubled. Estate Tax Exemption Basic Exclusion Amount 11700000. In 2022 couples can exempt 2412 million.

The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person. Gift and Estate Tax Exemptions The Unified Credit. The unified tax credit is in addition to a gift tax exclusion an amount you can give away per person per year without dipping into the credit.

Then there is the exemption for gifts and estate taxes. The lifetime exemption was worth 117 million for tax year 2021. Or of course you can use the unified tax credit to do a little bit of both.

The Estate Tax is a tax on your right to transfer property at your death. The extent of the benefit provided by the unified tax credit depends on the tax year in which you intend to use the credit. However you wont necessarily need to worry about paying taxes on those gifts if you havent reached your lifetime.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. Youre able to give 15000 to up to 10 different people for a total of 150000 going out of your accounts without the need to deal with taxes.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

What Happened To The Expected Year End Estate Tax Changes

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

A Brief History Of Estate Gift Taxes

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Law Changes What To Do Now

U S Estate Tax For Canadians Manulife Investment Management

South Carolina Estate Tax Everything You Need To Know Smartasset

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Talk To Clients About Estate Taxes Lifetime Gifts Corvee

Current Tax Legislation And Estate Planning Practices

Warshaw Burstein Llp 2022 Trust And Estates Updates

Exploring The Estate Tax Part 2 Journal Of Accountancy

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

2021 Tax Laws Federal Tax Updates Maryland Estate Taxes Mcnamee Hosea